Self-employment and Covid-19 support

In a time of unprecedented uncertainty across the world, many self-employed workers have been left in a state of uncertainty and anxiousness over their upcoming income. The UK have announced clear guidance for employed professionals, with he 80% Covid-19 salary cover. However, the protection for sole traders and small business owners is not currently so clear.

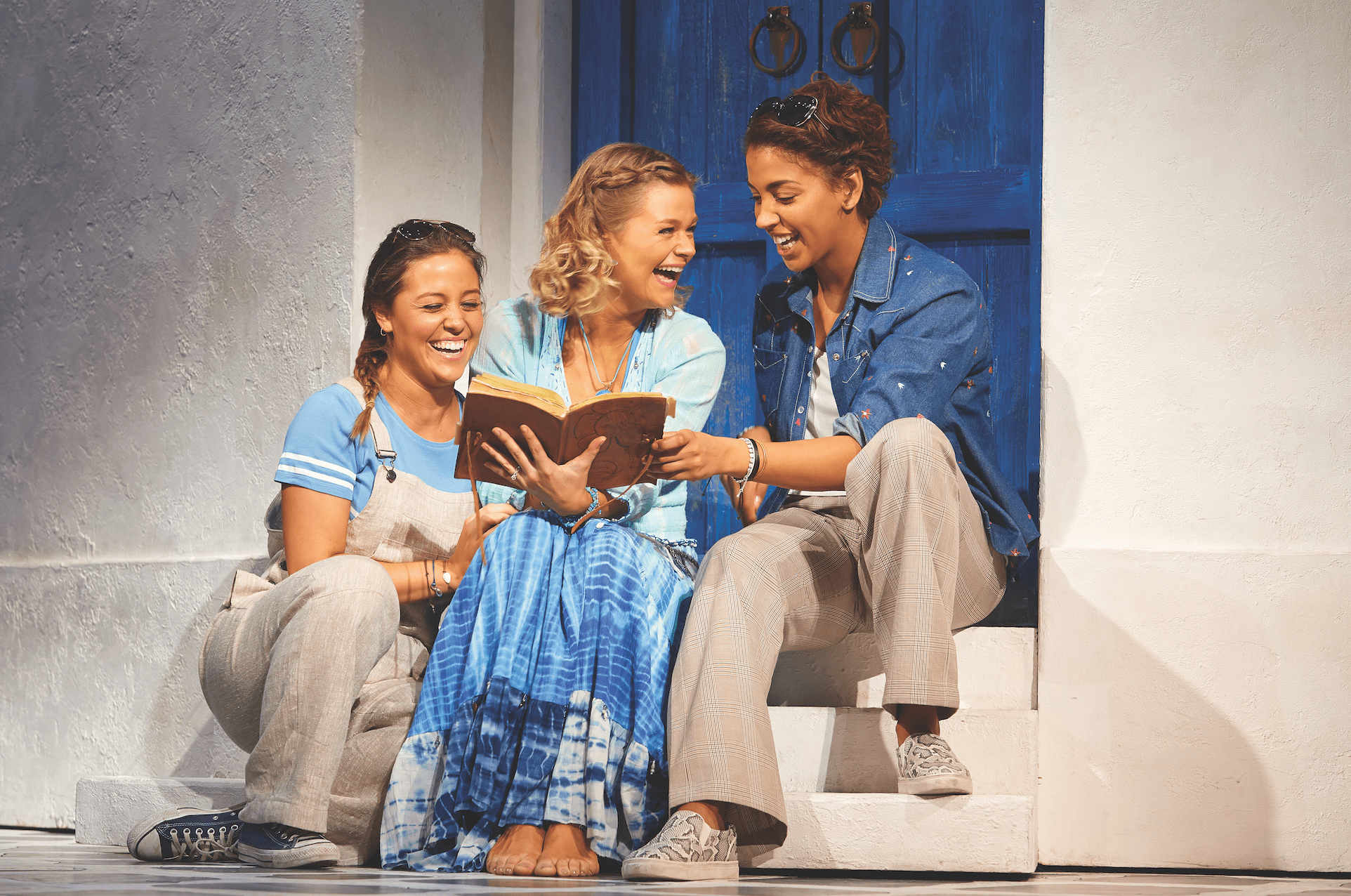

Many and most creative industry workers will be staying at home and out of work after last nights announcement from Boris Johnson. There have been many reports already of how the pandemic is crippling the creative industry. Many creative industry associations, such as Equity and The Creative Industry Federation, have released open letters and petitions to to the government demanding more support for creative industry workers.

Already, we have had clients that have reported total loss of future income due to Covid-19 for the foreseeable future. We are working around the clock to ensure that we are keeping our self-employed clients up to date with the latest news on what is to come over the upcoming days, weeks and even months.

I am self-employed and have lost all my upcoming work, What can I do?

We have compiled a brief account on some of the support currently available. This is an area with high pressure on the Government for more information. We will be monitoring all self-employment support developments and keeping our blog up to date.

The Government has prohibited gatherings of more than 2 people and the closure of non-essential business- you may be able to claim income lost if you have insurance. We recommend you contact your insurance company to discuss as soon as possible.

As many will already know the financial support that is available right now is Employment and Support Allowance (ESA) alongside Universal Credit. The charity “Turn2us” has created a calculator so that you can find out the benefits you might be entitled too.

This is not the only support being offered. The government has recently declared that income tax payments due in July 2020 “will be deferred to January 2021”, stating that the process will be ‘automatic’ with ‘no applications required’. One of the major Covid-19 financial aid reliefs that self-employed workers can benefit from is the Mortgage Holiday and Eviction protection legislation

Small and medium businesses (businesses with ‘less than 250 employees’) can also access Statutory Sick Pay (SSP) relief. “This refund will cover up to 2 weeks SSP per eligible employee” off work due to COVID-19.

Many unions and societies are coming together to help self-employed people at this time. The ‘Musicians Union’ (MU) has invested £1 million to its new “Coronavirus Hardship Fund” for MU members. Offering in the way of financial support to members of the Music Union who apply.

The ‘Arts Council’ also recently announced that their priority has shifted to helping support ‘people who work in arts, museums and libraries” through the means of refocusing grant programs to ‘compensate individual artists and freelancers for lost work.

Amongst this, the small steps should not be ignored. Things such as making sure you are up to date on your invoices and managing any savings to prepare for any financial losses you may experience in the coming months. The Times has published an informative article about this.

MOVING FORWARD

The most important piece of information to gain is the knowledge you are not alone. Self-employed individuals account for 15% of the workforce within the UK, which is a statistic the government will be fully aware of. As pressure builds from the various societies and unions the government it is likely more aid and clarity will be provided to self-employed individuals.

Contact us for tax advice for self-employed professionals